People who own real estate catch a free ride in the wealth creation stakes.

Residential real estate prices endlessly outrun all other metrics. That’s why real estate owners get further and further ahead of the people who don’t own real estate.

And the people who own a lot of real estate endlessly get further ahead of the people who own just a little bit of real estate.

It’s a case of “To those who already have, more is given”.

“Hey guys, wait for me!!”

Between 1991 and 2017, Australian residential property prices rose by 313.5%, according to CoreLogic’s statistics. To put that in perspective, in comparison, over the same period:

- average weekly ordinary-time earnings rose for fulltime adults rose by 171% – only about half the increase in property prices.

- the consumer price index rose by only 89%, and

- Australia’s economy (as measured by real GDP) grew by only 128%.

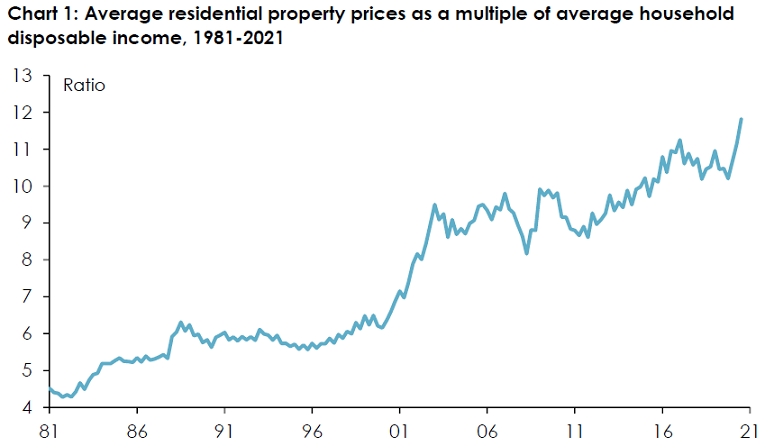

In 1981 the price of an average residential property cost around 4 times the average wage. Ten years later, in 1991 the price of an average residential property had increased to around 6 times the average wage. Now, an average house costs 12 times the average wage. It’s not hard to see that as time goes on, more and more people lose the ability to ever own a property. Yet the people who have already made a start find it easier and easier to acquire even more.

Note: ‘Residential property prices’ are the average of median sale prices across the eight state and territory capital cities; ‘average household disposable income’ is household disposable income divided by the civilian working-age (15 and over) population. Sources: CoreLogic, Home Property Value Index – Monthly Indices; ABS, Australian National Accounts: National Income, Expenditure and Product, March quarter 2021 and Labour Force, Australia, July 2021.

Many people enjoyed this free ride up the wealth escalator – capital gains of 313.5% just for being a property owner (while wages increased only 171%, about half as much). At the beginning of this period in 1991, 3.2 million Australian households (out of a total 4.5 million residences in all of Australia) owned a home to live in. To be exact 68.9% of households were owner-occupiers, so 31.1% were tenants.

Also, in 1991, 750,000 people owned at least one investment property. Now, 2.2 million individual Australians own at least one investment property. And 600,000 people own two or more investment properties. And over 20,000 people own six or more properties.

The huge rises in values no doubt helped these people become better off financially. “Normal looking” people became multi-millionaires – just like in the book “The Millionaire Next Door”. And of course, the people who owned more properties got an exponentially larger benefit than people with fewer properties e.g. think of a person with one property getting a 313.5% gain; then think of a person with 50 properties getting a 313.5% gain.

Renters and young people get left behind. Already, almost one-third of Australian households are people who might have expected to step on to this wealth escalator – but when the time comes, they will find that they cannot. When property values rise much faster than wages over the years, decades and centuries, some people who would have bought a property, miss out – and they miss out forever more. The boat has sailed.

And people with one property get left behind compared to the people with two properties.

And people with 10 properties get left behind compared to people with 50 properties.

Between the 1991 and 2016 Censuses, Australia’s home ownership rate fell from 68.9% to 65.5%. In other words the percentage of renters increased from 31.1% to 34.5% – and it will get worse as the years go on.

The older the civilisation, the higher the percentage of the population become trapped as renters. This is because older civilisations have experienced more decades and centuries during which property values increased faster than incomes. Every year, more people miss out and remain permanently on the sidelines as renters. That’s why in USA 50% of people are renters and in Europe 70% of people are renters. People in the older continents have had more time than Australians “to just miss the cut”.

Here is a little story. Kay, the mother of one of the people who work at Canterbury used to own a café in Berlin. For many years an elderly lady came in daily for a cup of coffee. She was known as a “landlady”. After being friendly for years, Kay eventually asked her “How many properties do you own?”. The elderly lady answered “About 2000 apartments”. Kay gasped and said “OMG, how did you get so many?” The elderly lady replied “I don’t know, our family just built them up over the generations”.

Australia is not yet old enough to have many elderly ladies sitting in a café owning 2000 properties, but we will eventually have lots of people like that.

The people who already own something, will get more. The people who already own a lot, will get a lot more.

No-one misses the boat if they are Canterbury clients.