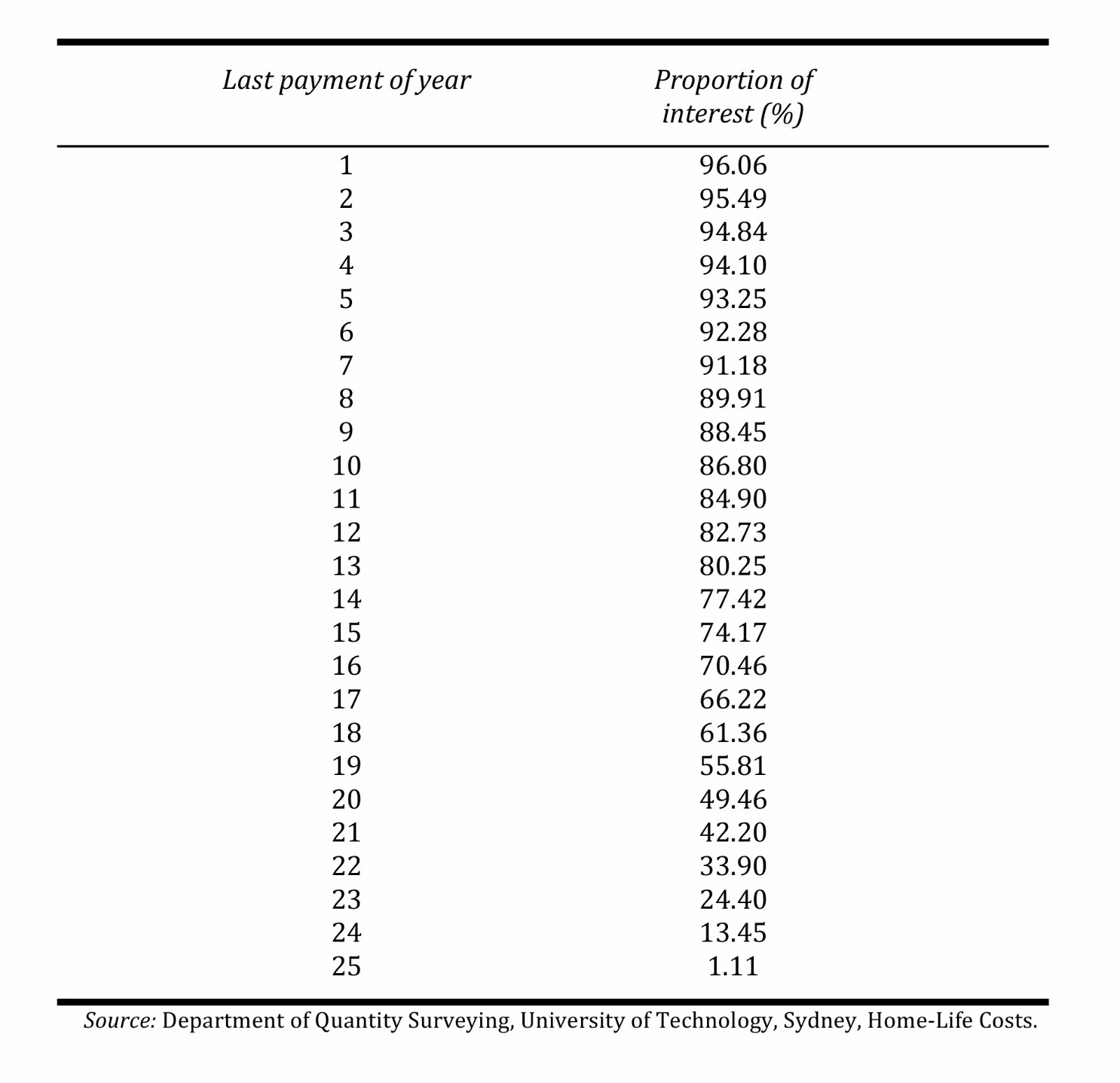

The below table shows the proportion of interest in each mortgage payment on a 25 year principle and interest home loan.

As you can see, the last payment in year 1 is 96.06% interest. That means only 3.94% reduces the loan.

As you can see, the last payment in year 1 is 96.06% interest. That means only 3.94% reduces the loan.

Even in year 10, the monthly payment is still 86.80% interest and only 13.20% of your payment reduces the loan.

This is all “good fun” for the bank – you hardly pay anything off the starting principle balance for 20 years. The good news is there is a way to prevent the banks from “owning you” like that – and that’s what we offer.

It is imperative to regain control and power by paying off your home completely and absolutely in 3 to 5 years, not 25 years.

Things become possible to you once you eliminate the non-tax deductible home loan. To leave your loan there any longer than necessary is to prolong the pain and remain a slave to the financial system.

Under our system a typical scenario is that a 25 year home loan is paid off in 3 to 5 years – using no extra payments. This is not a joke. We have been in business for 38 years. Let us explain how we do it.

For now just reflect on this. A $350,000 home loan at 6% interest paid off over 25 years incurs $325,753 in interest. The same home loan paid off over 5 years (using no more of your own money) incurs only $55,172 in interest.

Which do you prefer? Let us implement this for you.