The rising and falling of interest rates is just a fact of life as a property investor. This is a cyclical business in all ways. All that matters is what happens long term.

Every industry has occupational hazards. Even a rugby player gets tacked and knocked down, but he knows that will happen before he ever plays and knows as along as he wins the game that’s all ok.

Interest rates were never going to stay at all-time lows forever. Everyone knows it was a temporary measure to save the day during Covid. Interest rates needed to increase to curtail inflation. We are glad about the rate rises, it had to happen. This is of no harm to us. The minuscule rate rises are offset by a higher tax rebate on your investment property.

If interest rates were not adjusted upwards just now, inflation would have got out of hand, and that would have been the real problem. Another way to say that is: what use would it be to you if interest rates stayed ridiculously low, but inflation dramatically increased the price of all goods and services you buy….and remember you don’t get a tax deduction for dearer electricity or milk. ATO subsidise interest payments by tax rebates, but not so electricity or milk.

As things stand, there is no problem to Canterbury and not likely to be a problem. Look at it this way, interest rate rises are merely a partial return to where they used to be not long ago. Interest rates are not “rising” they are merely “normalising” – but that would be a boring thing for a journalist to say.

As they say in the news world “If it bleeds, it leads”. And the recent interest rate rises can be made out to sound like some “bleeding”, but is it really? Not at all! The headlines said “Market shocked, biggest rate rise in 22 years”. But was it a shock? Not at all. Is it significant? Not at all.

The obsession the media has with catastrophising every little incremental interest rate rise is irresponsible. All that is happening is that the Reserve Bank is ever so gently peeling off the easy money band-aid and the media is like a wimp saying “It hurts so much”. Canterbury are here to look into your eyes and say “It doesn’t hurt at all, the hurt was 32 years ago in 1990”.

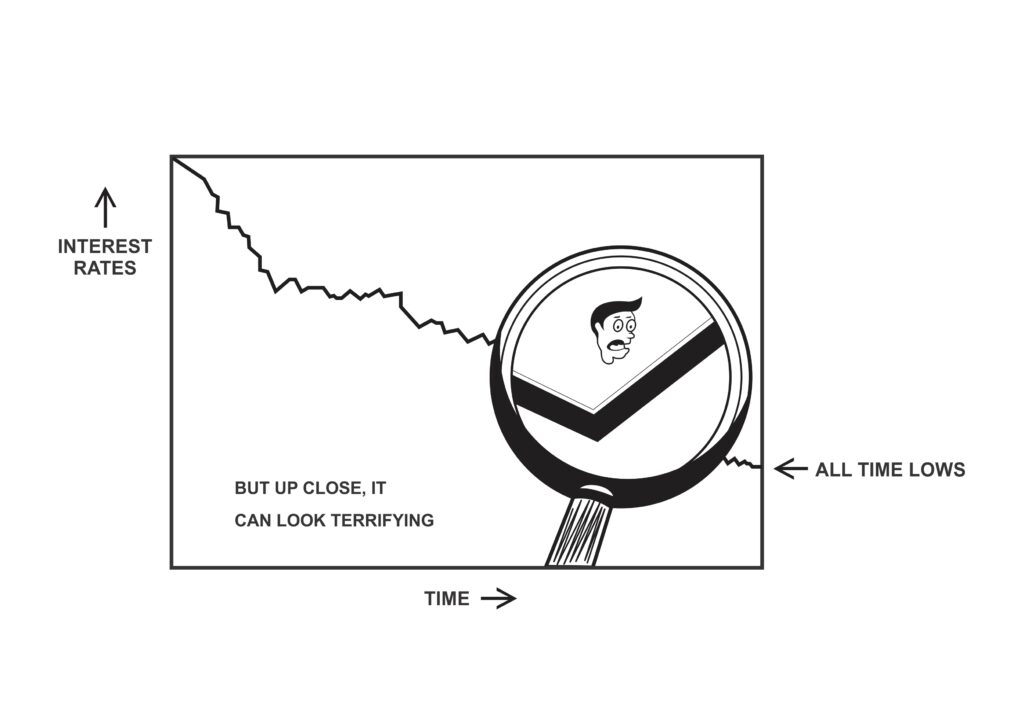

In 1990 the cash rate was 17.5%. “How about them apples”. If you zoom out, interest rates are still ridiculously low and likely to stay that way. This cartoon will explain.

FROM A DISTANCE IT IS OBVIOUS THAT INTEREST RATES HAVE BEEN ON A DOWNWARD PATH FOR A VERY LONG TIME

Success comes from what happens over the long term, not what happens today or this week.

Ninety-nine percent of success of most things comes from merely holding on over the long term. Even missing a few years can cripple the over-all long term capital gains we planned for. Look at this example from the decade of 2000’s.

If you owned a property for the full decade of the 2000’s, average capital gains were 196%. [a $600,000 property of today would become $1.776M]

In comparison, if someone suffered a knee-jerk reaction to the events of the day during that decade and missed just three years (2002, 2003, 2004) their average capital gain for the full decade would only be 43%. [a $600,000 property of today would only become $858,000]

That’s a lot to lose and that’s what many people did – because mortgage interest rates were “horror, horror” over 6% at that time spooked them (and 6% is still less than the long term average interest rate).

However that’s not what we did personally and it’s not what Canterbury clients did at that time.

There is always a way to hold out for the long term and pick the ripe fruit, not the green, immature fruit. Bear in mind the higher the interest rate goes, the higher the tax rebate. Even if interest rates returned to 6% (and they won’t), it would cause a negligible effect on the cash flow of your investment properties, especially considering the larger tax rebate.

Holding on and solving inevitable problems is where the great success comes from – the success enjoyed by the landlords who own hundreds of properties – the same people who in their early years, solved the same problems new investors face now. And they will handle it again this time round.