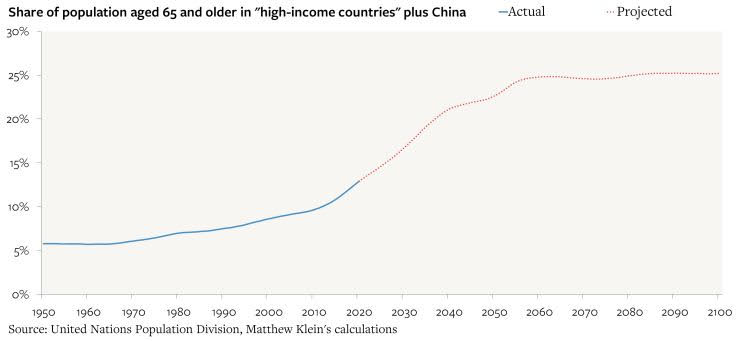

Not long ago only 5% of the population were over 65 years old (“elderly”). Now it’s around 14%. Soon it will be 25%.

Of great impact over the coming decades is the ageing population, with fewer workers available to finance the support and Centrelink benefits of the ever-aging population. Workers (younger people) are more productive than non-workers (older people) The economy (and accordingly family finances) cannot sustain as we know it with an ever increasing proportion of the population retiring and becoming unproductive economically.

According to the Intergenerational Report (IGR), as recently as 1982, there were 6.6 people of working age for each person over 65.

Now in 2021 it is 4 workers for each non worker.

By 2060 it will fall to 2.7 workers for each non-worker.

It is similar in most developed countries. The global economies with the highest incomes and output are experiencing a rapid increase in the proportion of population of people aged 65 and over.

Where will it all end? Something has to give. A lot of people/families are going to end up in a poor and compromised financial situation over the generations.

Now is the time to future proof yourself and your ongoing family.

If you can secure the future finances for your family now, subsequent generations will know that you were the one who did it all.

Canterbury have the proven plans to make this happen.